Don’t Break the Bank

All data courtesy of the FDIC (2005-2015)

In any city in America you could drive down main street and and on pretty much every corner there would be a bank within sight. Walk in to your bank however and ask “Can I see my money?” and you will be looked at like you’re crazy. From the average consumer to the business professional, the typical image of a bank is the front office and the cash in the drawers. If asked, take away the name and the colorful logo, anyone would probably have a hard time telling each bank apart. Does our money all go to the same place, and what differentiates 1st Bank on this side of town from 2nd bank on the other side of town? Banks will definitely take our money, and since they all pretty much look the same on the outside, it is important to look at what the industry looks like on the inside and to know where that money goes once it gets past those heavy vault doors.

This product is made navigable for the average consumer, but would also be relevant in a professional setting to an audience with a somewhat wide range of background knowledge about the banking industry. In approaching the questions at hand, the information needed to be in depth enough that it would be still be worthwhile to even the experts of the topic but not so overly complicated that these experts would be the only ones who could make sense of it. Specifically, the generated information can be implemented in a wide array of settings, including the very type of organizations where the data comes from.

The data set used for this project was collected by the Federal Deposit Insurance Corporation, the institution that insures the safety of every depositor’s funds at every bank in the country. Because it is in their best interest to have up to date statistics on every aspect of the institutions they cover it is a reliable source, but also a good example of an audience that could be consumers of these types of visualizations. Everyone working at the government agencies that regulate and monitor the banks need to have a general knowledge of the industry as a whole in order for the organizations to operate and manage banks effectively. With this in mind, the following visualizations could be useful to someone such as a consumer interested in the banking industry or a new employee entering the field that wants to know more about what the layout of the professional world they’re entering looks like.

The Big Four, Assets, and Yearly Profit

This first visualization depicts an important aspect of the banking world which is that out of the thousands of banks that are in operation, four of them hold nearly half of the total assets in the industry today. This is shown yearly by the pie chart in the top left-hand corner. Assets by definition are any and all resources owned by the company that contain value and can be represented in a dollar amount. This means that less than 0.1% of all the banks in our nation, in the most recent data, hold 40% of all of the the value in this multi billion-dollar industry. This is such an important aspect of the industry that it is necessary to be one of the first pieces of information in the visualizations. These four banks effect the entire industry, and the way the economy operates as a whole, because they have so much control of the public’s money. As the visualization shows, over the past ten years these banks have grown even larger relative to the rest of the market making it important to consider how they are performing over the years compared with other banks.

Included with the pie chart is a line graph for the past ten years that displays the undivided profits of the four big banks on the left vertical axis. Undivided profits are a good measure of a banks performance because they represent the retained earnings of the company, or in other words its net income for the year. This graph reveals that while the banks are getting larger, the yearly profits that they make do not necessarily grow every year. It is important to note that while profits show what the company is earning, positive numbers do not always reflect good results. High performance and improvement is generally reflected in growing profits. Because of this it is important to notice the slope of the lines on the graph, as downward trends can be an indicator for poor bank performance compared to the previous year.

This graph brings up a second crucial detail of the banking industry, banks are not always getting rich off of our money and there are some important years in recent history that reflect this. In 2008 our country went through its worst financial crisis since the great depression, and in 2007 the image shows that three out of the four big banks saw their largest yearly decline in profits in the past decade. The rest of the banking industry as a whole also saw a huge decline in profits in the two years preceding the financial crisis. These years, and the ones immediately following, are important to keep in mind to observe the precursors and effects of an economic recession.

While it is not always the case, bank performance is generally a good indicator of how the economy as a whole is performing in our society.

Decreasing Number of Individual Banks in the Industry By Year

Every year, there are new banks that form and open up for business and there are banks that for one reason or another can no longer operate and have to shut down. In the past decade the number of banks that have closed has far outweighed those that have opened. Every year hundreds of banks have closed and every aspect that has been discussed thus far likely has contribute to this. As the four big banks continue to grow in size, the rest of the industry finds their strongest competitors becoming even larger. Bigger banks have more resources in every field which can make them very difficult to compete with. Additionally, the first dashboard demonstrated how the entire industry’s profits took a hit during the recent financial crisis. Many banks were unable to survive the aftermath of the economic downturn and subsequently had to go out of business after failing to recover. While there are some banks that are doing very well, it is a difficult industry to enter and an just as challenging to survive in.

This not well-known trend leads to the next pair of visualizations that address questions brought up from the previous images. What what could have caused this downturn in profits and was it drastic enough that the industry as a whole has been suffering from it as shown from this decreasing number of banks?

The Build Up, and the Big Crash

The next two visualizations attempt to depict just what went wrong in recent years to induce a financial crisis that effected economies around the world.

In order to make the figures more understandable begin by thinking of values in terms of the common deposits that go into a bank. These are the dollars sitting in each and every account across the country, and are represented by the grey bars on the chart. Part of these deposits banks then turn around and loan out to others in need of funds, who promise to pay it back often with interest. These are represented in the dark green bars as “net loans and losses”. Finally, these net loans and losses are comprised mostly of securities and volatile liabilities, both represented as the two lighter green columns.

The dollars you give to the bank are not just sitting in the vault, this gives a good sense of where they are actually going.

Importantly, remember the crucial years previously discussed and look at changing trends in the industry in this chart.

Immediately what stands out is the peak of loans being given out by banks in 2007 which then decrease in the following years. Following the breakdown of the chart, which shows the make up of these types of loans, is another peak in the 2007 to 2008-time frame of volatile liabilities. These liabilities are among the riskiest ways a bank can accumulate borrowed money, hence the term “volatile”. Among the types of liabilities that can be classified in this category include many mortgages, loans that were key during the housing crisis that played a role during the recent financial downturn.

In the years leading up to this downturn, banks were lending out mortgages at an unprecedented rate to consumers. Initially, these mortgages are assets to the bank as the banks are the ones who get paid back with interest by the lenders. However, investments firms began buying these mortgages in bulk from the banks, meaning the banks would package together thousands of these loans and then in effect sell them off, making them a liability to the bank. More and more people continued to take loans out for houses, people who in many cases should not have been able to afford these homes. The banks though, could just continue to sell them off as long as there were buyers, which is reflected in the graph as at its peak in 2008, banks had $4.8 billion in volatile liabilities.

Eventually though, homeowners could no longer afford to make payments on their original mortgages, and loan defaults began to skyrocket. In a whirlwind of missed payments and foreclosures, the housing bubble burst and all of a sudden the value of these volatile liabilities became a fraction of what they used to be. The loss in valuation of these liabilities had consequential effects on almost every aspect of the economy, but these visualizations attempt to show how it was reflected within the banking industry. The liabilities graph reflects how the value of these liabilities came crashing down causing banks to reduce their holdings in this sector an astonishing rate of over $1.5 billion in just two years. The loss of value is shown through the dramatic decrease of yearly profits across the industry in the very first image as banks had to sell a majority of these holdings for less than they were originally worth.

Additionally, this chart illustrates what happened to securities, another main form of what banks can do with our deposits, during this time period. In the US, securities, or debt securities, can be in the form of banknotes, bonds, or debentures. In essence, instead of banks giving your deposits out to other consumers so they can purchase something such as a house, the bank can also pay another entity for a security. These securities are then paid back with additional funds as interest after a predetermined period of time. Many securities, as in the name, can offer a very secure investment in which you get your money back and a return on. This graph clearly shows how after the housing market crashed banks invested much more of our funds in securities rather than volatile liabilities.

Interact with the Banking Industry

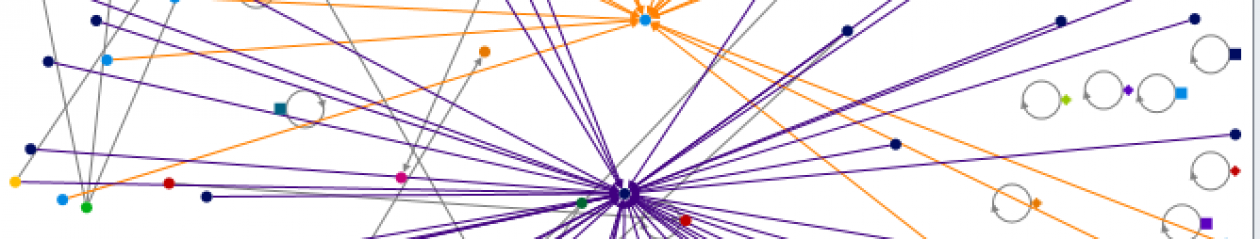

The final visualization is an interactive display that is meant to encourage the exploration of the data behind the banks that make up the industry. This display lets the user sift through the data on their own to discover and draw conclusions for themselves. It includes stats for individual banks that have been previously discussed, such as total deposits and a ratio for how much of those deposits are invested in volatile liabilities by the bank. Both sides of the visualization and all of the information it contains reflect the most recent set of data from 2015.

Search for banks, Filter By State, Or Click on Bubbles to compare banks and their statistics.

When searching for multiple items: first deselect “all” then type in the desired names in the search box and re-select those to include

On the right is a visual representation of the size of every bank in the industry. Size, like the pie chart, is determined by the total assets held by the bank, which is then reflected by the size of the “bubble” that the bank is depicted by in the visualization. You can hover over any of the bubbles to see more information on the bank and you can also select banks to compare by holding shift while clicking the ones you want to compare and then choose “keep only”. Additional statistics are displayed in the chart to the left for all of the banks that appear in the visualization on the right.

This chart displays some common information about all of the banks being displayed. If someone wanted to use it to compare specific information, any of the data variables could be listed here if need be. Currently the chart displays information that a consumer researching different banks may be interested in, such as the number of workers the bank employs or how many shares of stock the public owns. Up to five different banks fit in the view and the chart can scroll across if more are being observed. The real functionality of this visualization is in the user’s ability to select what banks they want to view or compare.

Selections can be made on either side of the display to pick out which banks to examine. On the left is a drop down where the user can select or deselected every bank available and there is also a search functionality. The best way to use this is by deselected “All” first and the search for banks to select. Each one that is selected will also show up as a bubble on the right representing the size of the bank in comparison to the other selected ones. This means that Every bank that is selected will show up both in the data table and in the bubble visualization. The list can also be filtered by state, but it is important to remember that each bank’s state is represented by where they are headquartered, and can only be included in a single state. It is also important to note that there are some banks that have the same exact name, take Park Bank for example. In this case two sets of statistics will show up in a single column, but both will have a bubble representation on the right. This can be filtered further however, as the visualization on the right can also be used to select which banks.

By simply clicking on any bubble, the statistics for that bank will show up in the display on the left. To select multiple, hold shift and click on all of the banks you want to compare and the data for only those selected will show up on the left.

All of the displays can be used as tools for learning and to make connections from the big picture down to comparisons of individual banks. This final visualization is a powerful interactive tool that can be used for a wide range of needs for the originally described target audience, but also for anyone that is interested in learning more about individual banks in the industry. These visualizations are as much about relaying information as they are about sparking further interest in the industry.