An aerial view of layoffs and employment in Wisconsin

Last year had the most layoffs since the Great Recession

There’s a new headline every few weeks: “Ripon cookie plant closing, hundreds to lose jobs;” “Oscar Mayer will close plant and move 1,000 jobs out of Madison;” “Johnson Controls announces 277 more layoffs.” A handful of jobs disappear on one side of the state; several hundred disappear on the other. Companies explain why tax breaks elsewhere, an acquisition or decreased demand for their products caused the layoffs to be necessary. Readers skim each account, briefly mourn the loss and, assuming it doesn’t directly impact someone they know, don’t think much of it.

Rarely do readers get a chance to examine trends and patterns.

In 2009, the Great Recession’s effects were reverberating across Wisconsin and nearly 18,000 people in the state lost their jobs, according to the Department of Workforce Development’s Plant Closing and Mass Layoff notices.

For the next five years, as the economy rebounded – or at least settled on a new normal – unemployment inched downward and the number of positions cut each year soon hovered around 6,000.

But in 2015, nearly 10,000 Wisconsin workers lost their jobs. It was the highest number since 2009. Taking a detailed look[1] at layoff patterns helps explain why – and illustrates the changes underway in our state.

Manufacturing not hardest hit in 2015

When most Wisconsinites think of layoffs, they think of the 1,000 jobs lost at Janesville’s General Motor plant and shuttering paper mills and factories in non-urban areas of the state. The popular narrative is that manufacturing jobs are disappearing. While many manufacturers are in fact downsizing, sending jobs overseas or closing their doors altogether, the manufacturing industry did not top the list for laying off the highest number of workers in 2015.

Surprisingly, layoffs at companies in “professional or technical services” outpaced layoffs at manufacturing companies last year. Professional and technical services – which includes IT technicians, lawyers and consultants – are commonly considered more stable jobs because client-facing work is logistically harder to outsource than production roles. This could be valid: Subsequent visualizations will show that the rise in professional company layoffs in 2015 was largely attributable to a few companies. Plus, 2016 filings through early May suggest that manufacturing layoffs will outpace the other categories, and that layoffs in professional and technical services will fall toward the end of the list (more on 2016 later).

Jobs in medical fields, which are also considered very stable and are projected to grow rapidly, saw the third highest amount of layoffs last year.

One industry notably absent from the list is construction. “When you look at the building boom going on, there’s a huge amount of work for building trades,” said Phil Neuenfeldt, president of the Wisconsin AFL-CIO, a large workers’ union. This is not the case for manufacturing jobs, which are either holding steady (when job creation is factored in) or losing ground, he said.

A few companies account for a large share of 2015 layoffs

A handful of companies accounted for nearly all of the increase in layoff notices in 2015. Three were professional services firms in Milwaukee: Time Insurance Corp., which does business as Assurant Health (1,200 employees), Wells Fargo (839) and Johnson Controls (277).

Assurant Health, a health insurance provider, announced plans to close last year after struggling to operate under the Affordable Care Act. Wells Fargo announced it would layoff nearly 1,000 workers at a loan servicing call center. The economy’s improvement and decline of mortgage delinquency lessened the need for the call center, according to the announcement. Earlier this year, the Department of Workforce Development secured more than $600,000 from the federal government to help those affected by the Assurance and Wells Fargo layoffs.

Two of largest layoffs in 2015 occurred at food processors: Dairy Farmers of America in Plymouth (304), and ConAgra Foods in Ripon (285). Other large layoffs included a nursing facility (287) and a manufacturer of sealed air components (300). Four companies in the mining industry laid workers off, three of which were in the Western part of the state where frac sand mining grew rapidly in the past few years and, in response to consistently low gasoline prices, recently contracted.

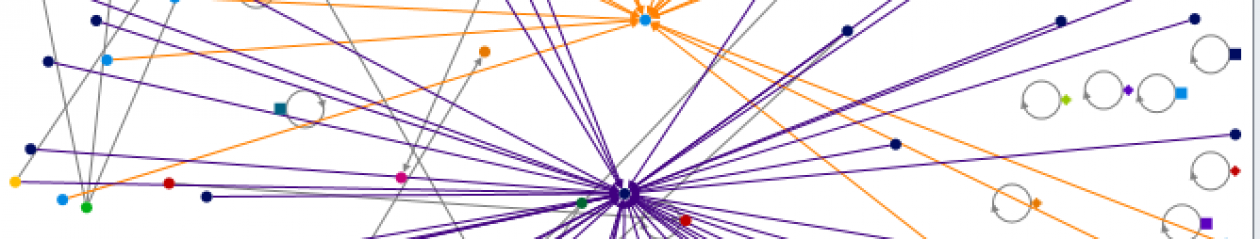

Layoffs spanned the state

Workers across the state felt the impact of layoffs last year, with layoffs scattered throughout Wisconsin. As expected, the more heavily populated areas, including the areas surrounding Milwaukee, Madison, La Crosse and Green Bay had the highest amounts of affected workers.

The radio buttons on the visualization help illustrate the industries impacted in each part of the state. The Northwestern part of the state was disproportionately impacted by layoffs in the mining industry. Cuts in food processing were confined to the Southeastern portion of the state: a ConAgra cookie plant in Ripon, two dairy processors near Sheboygan, Oscar Mayer foods in Madison, and McCain foods in Fort Atkinson. Four companies in the Eastern half of the state shed jobs in metal machining and sales. Manufacturing cuts dotted the entire map, but placed most heavily in the Milwaukee area. Cuts in medical fields, while they also dotted the entire state, disproportionately impacted less populated areas of Northwestern Wisconsin.

One city that was spared layoff filings in 2015: Janesville. The home of the former General Motors plant saw zero layoff filings last year. And recently, the city council approved a package of incentives to bring SHINE Medical Technologies to town. The company plans to create 130 new jobs with average salaries of between $50,000 and $60,000. While it doesn’t begin to make up for the jobs lost, Speaker of the House Paul Ryan, whose hometown is Janesville, hopes the project will inspire other high-tech companies to build in Janesville.

Long-time city council member Sam Liebert believes SHINE will help the city reinvent its reputation as a good place to do business: “I like to think that Janesville is a town of progress.”

Northern counties struggle with unemployment

Despite the fact that layoffs were most prevalent in the most populated areas, unemployment rates are currently highest in the state’s less populous, Northern counties. Bayfield County had the highest rate in March 2016, at 10.2 percent.

This area of the state has traditionally struggled with higher unemployment levels. Zamira Simkins, an economics professor at UW-Superior, called the region’s economy “a classic undevelopment situation” in a Journal Sentinel article last year. She also said areas with economies based on natural resources, which tend to be less profitable industries, create lower-paying jobs.

“It’s sort of a vicious cycle,” she said. The same article reported that because counties with less developed transportation systems tend to be overlooked for awards from agencies like the Wisconsin Economic Development Corporation, which further perpetuates the cycle.

New jobs and falling wages

On the other side of the labor market equation from layoffs is job creation. John Dipko, communications director of the Wisconsin DWD, said Wisconsin added about 31,000 jobs during 2015. While it sounds like a net gain when compared to 10,000 layoffs, it depends how the jobs created compare to the jobs lost.

In the midst of falling wages in Wisconsin, some people are warning that new jobs tend to be lower-paying and require fewer skills than the jobs being eliminated.

“We’ve taken a definite step downward,” Tim Smeeding, a professor of public affairs and economics at UW-Madison, told the Journal Sentinel. Smeeding attributed the income loss to the effect the recession had on the state’s manufacturing sector.

“Jobs in which a person without a college education could earn a middle-class wage disappeared only to be replaced by mostly low-wage positions,” the Journal Sentinel reported.

Further, the opportunities today do not feel the same to workers as they did before the recession. Laura Dresser, associated director of the Center on Wisconsin Strategy, a research organization housed at the UW-Madison, said this is because job replacement has not kept up with population growth. Dresser said over 70,000 additional positions would need to be created for the same level of opportunity to be restored.

The DWD has identified “hot” sectors expected to grow relatively fast over the next few years; whether the growth translates into more quality jobs for workers is up for debate. According to DWD projections, sectors expected to grow the fastest in Wisconsin between 2012 and 2022 include construction and IT. Construction could create 20 percent more jobs; IT could create almost 16 percent more. The largest expected growth in number of positions is in health care, a sector that could add more than 10,000 jobs.

Production, which includes most manufacturing positions, is projected to grow by 11 percent, or approximately 4,000 positions over 10 years, which is a small number given that the manufacturing industry hasn’t returned to its pre-recession size in Wisconsin.

Manufacturing layoffs up in 2016 so far

Layoffs this year appear to be in pace with the five-year stretch before 2015. The majority of layoffs through May 9 were in the manufacturing and food processing industries.

On April 25, Kraft Heinz filed layoff notices for 561 workers at the Oscar Mayer plant in Madison, which was 2016’s largest individual layoff notice so far. Layoffs will begin there in late June.

[1] Because private (non-governmental) companies with more than 50 employees are required to report plant closings or layoffs to the the state, the data used in these visualization is readily available from the Department of Workforce Development. It is important to note that the data in this analysis counted initial notices only. The majority of layoff updates were to provide the DWD with more precise information regarding the timing of layoffs, not to alter the number of people being laid off. Additionally, the amount of rescinded notices in 2015 was less than 5 percent of total layoffs and therefore determined to be negligible.

Each company noted its industry in the layoff filing, but it was necessary to combine the industries into broader groups to present the industry data in a meaningful way. Any subcategory with manufacturing in the title became Manufacturing, except for companies relating to food manufacturing, which were placed in their own category. Two businesses without manufacturing in the industry name also fell into the category upon further review. Consumer goods or services included supermarkets, retail stores, retail warehousing operations and services like golf courses and storage space. Medical, nursing and personal care included both home care services for the elderly and disabled, hospitals and nursing facilities and child care. All other category determinations were straightforward.